Which of the Following Procedures Best Describes Activity-based Costing

All of the above. Which of the following procedures best describes activity-based costing.

Activity Based Costing Meaning Definitions Features Steps Limitations Benefits Uses And Examples

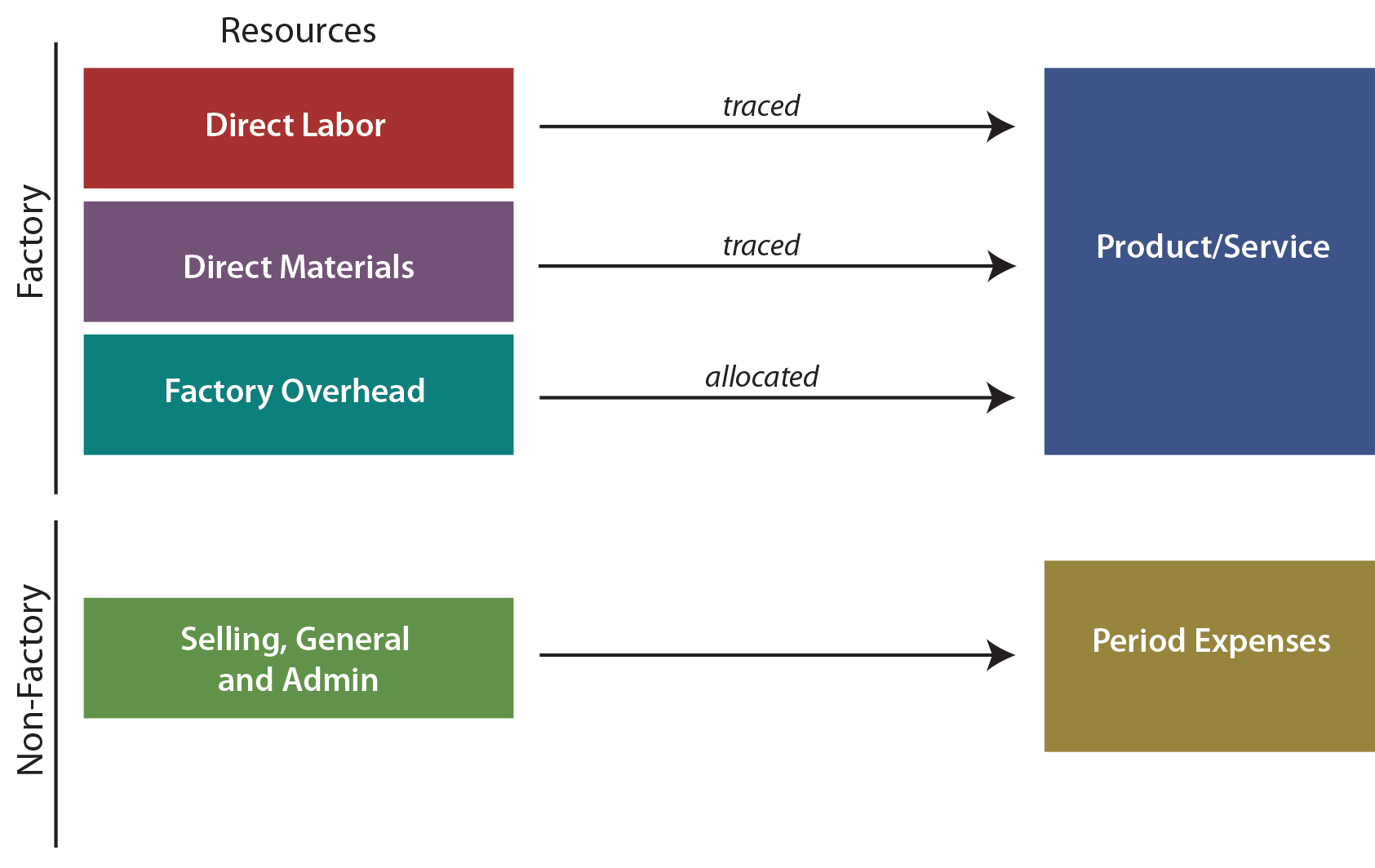

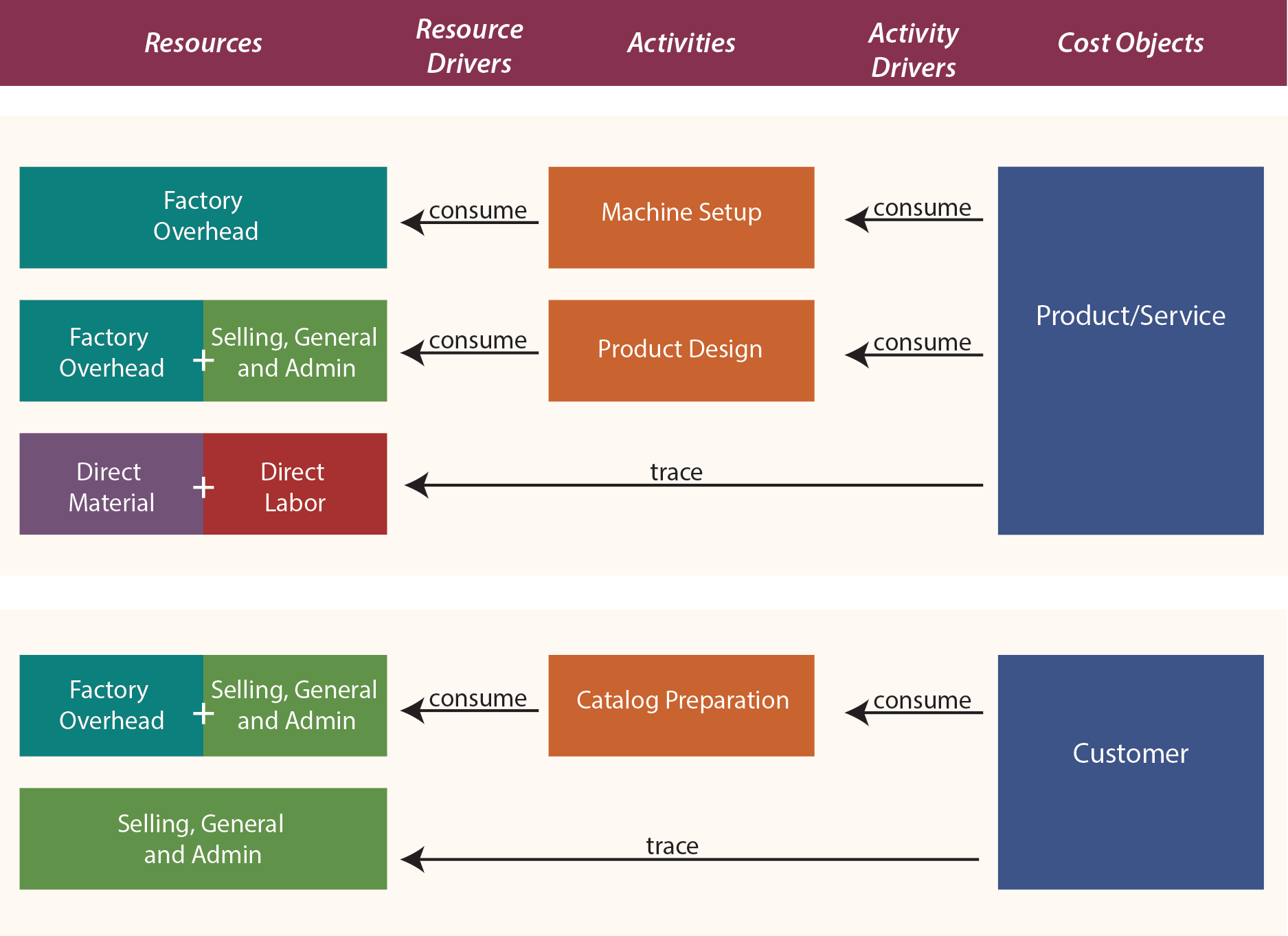

Take note that when we say Activity-based costing ABC this refers to the method which helps to allocate the overhead such as factory utilities depreciation indirect labor and materials based on the provided activities which normally often called as cost drivers purchase orders machine set up and etc.

. Overhead costs are assigned to activities. Partially completed goods that are in the process of being converted into a finish product are defined as. Which of the following best describes standard costing.

It assigns cost objects to its cost drivers. Then costs are. The following formula can be used.

Which of the following procedures best describes activity-based costing. Asset Demand and Supply under Uncertainty. 1 Which of the following best describes standard costing.

Then costs are assigned to products. Overhead costs are assigned directly to products. All overhead costs are recorded as expenses as incurred.

Overhead costs are assigned to activities. Which of the following procedures best describes activity-based costing. Activity based costing must adhere to.

The list consists of descriptions of a variety of activities including a. Overhead costs are assigned directly to products. A list of particular activities that are utilized in activity-based costing ABC analysis.

Overhead costs are assigned directly to products. In a two-stage activity-based costing model stage one involves. Advertising and Public Relations.

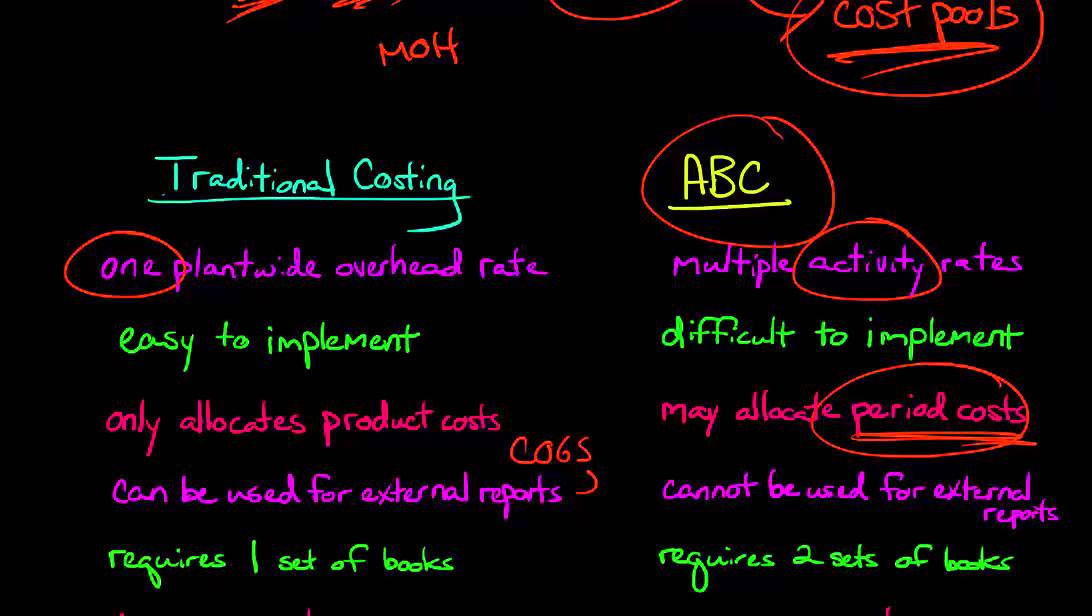

C Activity-based costing involves determining the cost of activities. 1Which of the following best describes standard costing. Overhead costs are assigned to departments.

Then costs are assigned to products. Which of the following procedures best describes activity-based costing. Overhead costs are assigned to departments.

Overhead costs are assigned to departments. The allocation of overhead by multiplying a predetermined rate by actual activity. Which procedures best describes activity-based costing Answered.

Then costs are assigned to products. Activity based costing focuses on assigning overhead costs. Analyzing and Recording Transactions.

Overhead costs are assigned to activities. Which of the following procedures best describes activity-based costing. Question 4 of 26 20 20 Points Which of the following procedures best describes activitybased costing.

The allocation of overhead by multiplying a predetermined rate by standard activity. All overhead costs are recorded as expenses as incurred. The allocation of overhead by multiplying a market-based rate by standard activity.

The correct answer is D. Cost pool is a group of separate costs connected to a single activity. B Activity-based costing involves tracing the cost of activities used by the various cost objects.

The allocation of overhead by multiplying a. Which of the following procedures best describes activity-based costing. D All of the above.

Overhead costs are assigned to activities. Overhead for Cost Pool Cost Drivers x Amount of Activity Cost Driver. Then costs are assigned to products.

Overhead costs are assigned directly to products. The allocation of overhead by multiplying a market-based rate by standard activity. Overhead costs are assigned to activities.

Then costs are assigned to products. Which of the following procedures best describes activitybased costing Overhead from ACG 6315 at Florida Atlantic University. Then costs are assigned to products.

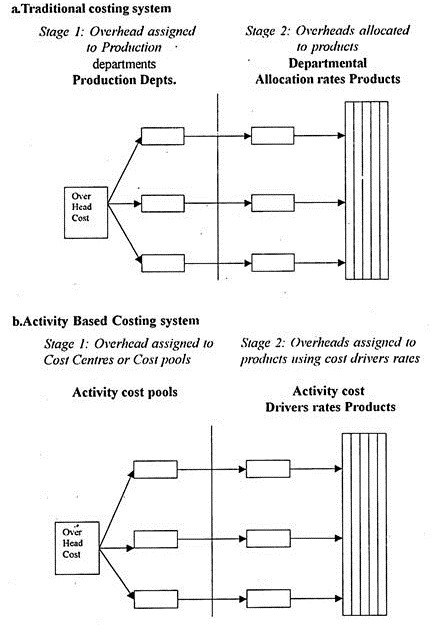

Adjusting Accounts for Financial Statements. Then costs are assigned to products. A The most widely used approach to activity-based costing involves the use of a two-stage model.

Which of the following statements best describes activity based costing. Overhead costs are assigned to departments. All overhead costs are recorded as expenses as incurred.

All overhead costs are recorded as expenses as incurred. Activity based costing can only be used by very large international companies. Which of the following procedures best describes activity-based costing.

Then costs are assigned to products. Once we get the the cost driver per unit we will then assigned the overhead to. Overhead costs are assigned to activities.

Then costs are assigned to products. All overhead costs are recorded as expenses as incurred. Overhead costs are assigned to activities.

Which of the following procedures best describes activity-based costing. Overhead costs are assigned to activities. Then costs are assigned to products.

Overhead costs are assigned to departments. Overhead costs are assigned directly to products. Activity based costing cannot be used in businesses that provide services to its customers.

The allocation of overhead by multiplying a predetermined rate by standard activity. Overhead costs are assigned directly to products. Which of the following procedures best describes activity-based costing.

All overhead costs are recorded as expenses as incurred. The allocation of overhead by multip. Analysis and Forecasting Techniques.

To use this costing method one must first understand how costs are assigned to activities. Then costs are assigned to products. Advertising and Sales Promotion.

Then costs are assigned to products. All overhead costs are recorded as expenses as incurred. All overhead costs are recorded as expenses as incurred.

The allocation of overhead by multiplying a predetermined rate by actual activity. Then costs are assigned to products. Which of the following procedures best describes activity-based costing.

Group of answer choices. Activity-based costing has a two-stage model. Overhead costs are assigned to activities.

Activity-based costing determines the cost of activities and traces their costs to cost objects on the basis of the cost objects utilization of units of.

Activity Based Costing Principlesofaccounting Com

Comments

Post a Comment